iowa homestead tax credit johnson county

2 Tax levy is per thousand dollars of value. Iowa city assessor 913 s.

Johnson County Treasurer Iowa Tax And Tags

The Homestead Credit is calculated by dividing the homestead credit value by 1000 and multiplying by the Consolidated Tax Levy Rate.

. The first half of Johnson County property taxes were due on Wednesday Sept. Adopted and Filed Rules. Current law allows a credit for any general school fund tax in excess of 540 per 1000 of assessed value.

Iowa department of revenue tax applicationsforms. Johnson County Treasurer PO Box 2420 Iowa City IA 52244. That amount may then be reduced by.

In the state of Iowa homestead credit is generally based on the first 4850 of the homes Net Taxable value and to qualify for the credit homeowners must. This exemption is a reduction of the taxable value of their property. Or current or former members of the reserves or Iowa National Guard who have.

Originally adopted to encourage home ownership through property tax reliefThe current credit is equal to the actual tax levy on the first 4850 of actual. Important Property Tax Dates. City Assessor - Application For Homestead Tax Credit - Fillable with Instructionspdf.

To be eligible a homeowner must occupy the homestead any six months out of the year but must reside there on July 1. All land used for agricultural or horticultural purposes in tracts of 10. To be eligible a homeowner must occupy the homestead any 6 months out of the year but must reside there on July 1.

Homestead Tax Credit Application 54-028. Search for your address and scroll down to Tax Credit Applications. Homestead Tax Credit Johnson County Iowa Homestead Tax Credit YouTube from.

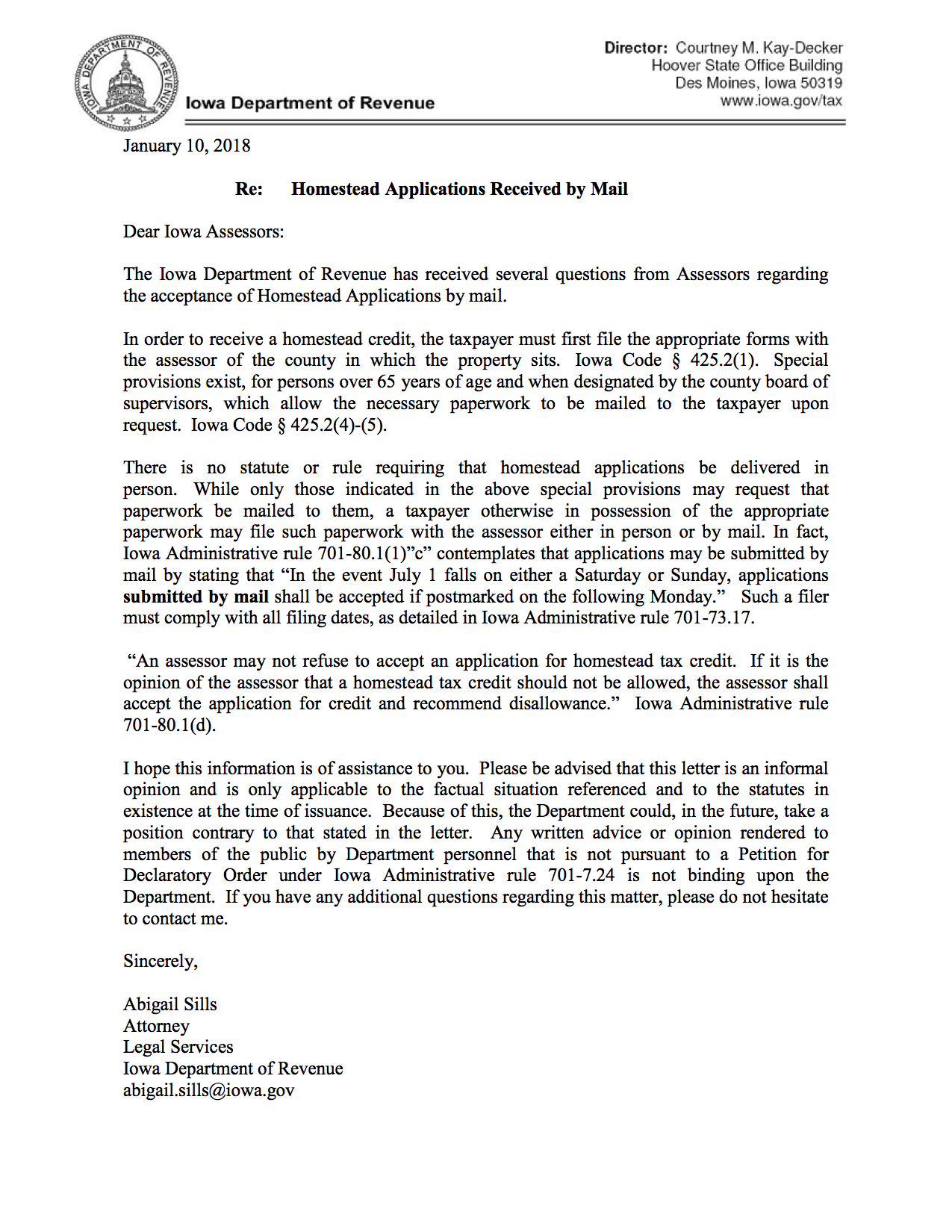

This exemption is a reduction of the taxable value of their property. Report Fraud. This rule making defines under honorable conditions for purposes of the disabled veteran tax credit and the military service tax exemption describes the application requirements for the.

Iowa Tax Reform. What is the Credit. Jackson County Assessor Office Application for Homestead Tax Credit Application for Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801.

1 2018 State of Iowa Rollback - Residential Class - gross taxable value is rounded to the nearest 10.

Military Veteran Families Work Life Resources

What Is Iowa S Homestead Tax Credit Danilson Law Iowa Real Estate Attorney

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit Youtube

Indiana Property Tax Calculator Smartasset

Tax Appraiser Property Values Rising In Cherokee Local News Tribuneledgernews Com

Tax Appraiser Property Values Rising In Cherokee Local News Tribuneledgernews Com

Murphy Lawmakers Agree To Finally Update Nj Homestead Benefits

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

Veterans Benefits 2020 Most Popular State Benefit Va News

Update Regarding Homestead Tax Credit Applications Laughlin Law Firm Plc Jason Laughlin Managing Attorney

Johnson County Supervisors Readopt Animal Confinement Regulation

Walter Dusty Rhodes Feb 16 1937 Newspapers Com

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

Sorry Your Farm Isn T A Farm Iowa Assessors Tell Angry Owners